|

SMARTNET™ ENERGY INFRASTRUCTURE

|

|

A BETTER PLACE TO LIVE - Imagine a means to store electricity as green hydrogen for the load levelling of national grids, while also supplying energy for commercial vans and heavy duty trucks. Fuel cells provide a way to convert hydrogen gas into electricity, but on their own they do not represent a solution. The way forward could be with hydrogen batteries, as the beating heart of the SmartNet™ dual-fuel infrastructure.

SmartNet™ potentially provides architectures for optimized interaction between

TSOs and

DSOs in managing the exchange of information for monitoring, acquiring and operating ancillary services (frequency control, frequency restoration, congestion management and voltage regulation) both at local and national level. Local needs for ancillary services in distribution systems should be able to co-exist with system needs for balancing and congestion management. Resources located in distribution systems, like demand side management and distributed generation, are supposed to participate to the provision of ancillary services both locally and for the entire power system in the context of competitive ancillary services markets.

• Which ancillary services could be provided from distribution grid level to the whole power system?

• How should the coordination between TSOs and DSOs be organized to optimize the processes of procurement and activation of flexibility by system operators?

• How should the architectures of the real-time markets (in particular the markets for frequency restoration and congestion management) be consequently revised?

• What information has to be exchanged between system operators and how should the communication (ICT) be organized to guarantee observ-ability and control of distributed generation, flexible demand and storage systems?

Before any of that, and with E-Mobility firmly in mind, the base unit needs to be established, upon which CCAM like cooperation might evolve.

RENEWABLE ENERGY SUPPLY INFRASTRUCTURE - TECHNOLOGY RACE

Solar and wind energy is not being used efficiently at present, and the situation will become more acute as we transition to 100% renewables from fossil fuels and nuclear power.

Though, coal is the fly in the ointment, kept artificially cheap, making hydrogen a harder fiscal sell, against denier lobbyists paid by fossil fuel companies like, ExxonMobil, to muddy the waters. And Scott Morrison, who has kept Australia EV free, in his quest to profit from coal exports. If hydrogen became competitive with smart tech, the Kangaroo state and all they supply, will soon become uncompetitive, for failing to keep up. Meantime, steer clear of cheap imports from coal fired Asia. The furnace heating the planet - at an alarming pace - accelerating sea level rise.

To win this race, we will need a mass produced method of levelling the electricity generated from nature, where nature does not respect human timetables.

This is all the more important with the drive for Smart Cities, and clean air, of which there are none as we write. Smart cities and towns, being those that are energy conscious, especially in terms of servicing electric vehicles. And now we have robotaxis and robotrucks making an appearance in increasing numbers, all of which will eventually need refuelling vending wise, as there are no humans to leap out and plug in an EV, on robotic vehicles.

Fortunately, the European Commission is considering such problems, though appears not to be linking grid supplies with vehicle electrification by way of integration, save for V2G for battery electrics, potentially making it very difficult for SME's with limited resources to apply for funding without incurring significant debt in the making. Each application costs Tens of €Thousands of Euros in admin time. First time applicants without a trading track record, may need to make multiple applications before being taken seriously, and still fall at the financial hurdle, where the Commission is risk averse, as in financially discriminatory.

Such chance taking on the part of a newcomer applicant is daunting to say the least, a disincentive, save for larger corporations and academia with substantial research budgets who might afford a pop - since they would not fall at the financial hurdle. Indeed, they may have been the recipient of several grants previously, becoming favoured developers, perceived as a safer bet, but with whom progress may be linear, rather than lateral - so slower - and in the end, more expensive. Worse, they may never find the solution in timely fashion.

Imagine if you will the bouncing bomb, invented by Barnes Wallace. It got the job done, but would never have seen the light of day in a peacetime situation, for it has no practical application, but during hostilities, technology accelerates ideas much faster. John Harrison's Marine Chronometer is another example of a small enterprise (sole trader) coming up with the solution needed in his time, against considerable opposition and Red Flag sabotage from the Board of Longitude.

Two calls in the pipeline in draft, that appear to be looking for a SmartNet™ kind of solution are seen below. At time of publication (21-04-2021) they were not live and details may have changed.

If anyone wants to form a consortium for such applications (as lead perhaps) we'd be more than pleased to contribute the design concept, as IP partners. We'd need a gas production concern, a utility and a vehicle end user to make a solid consortium.

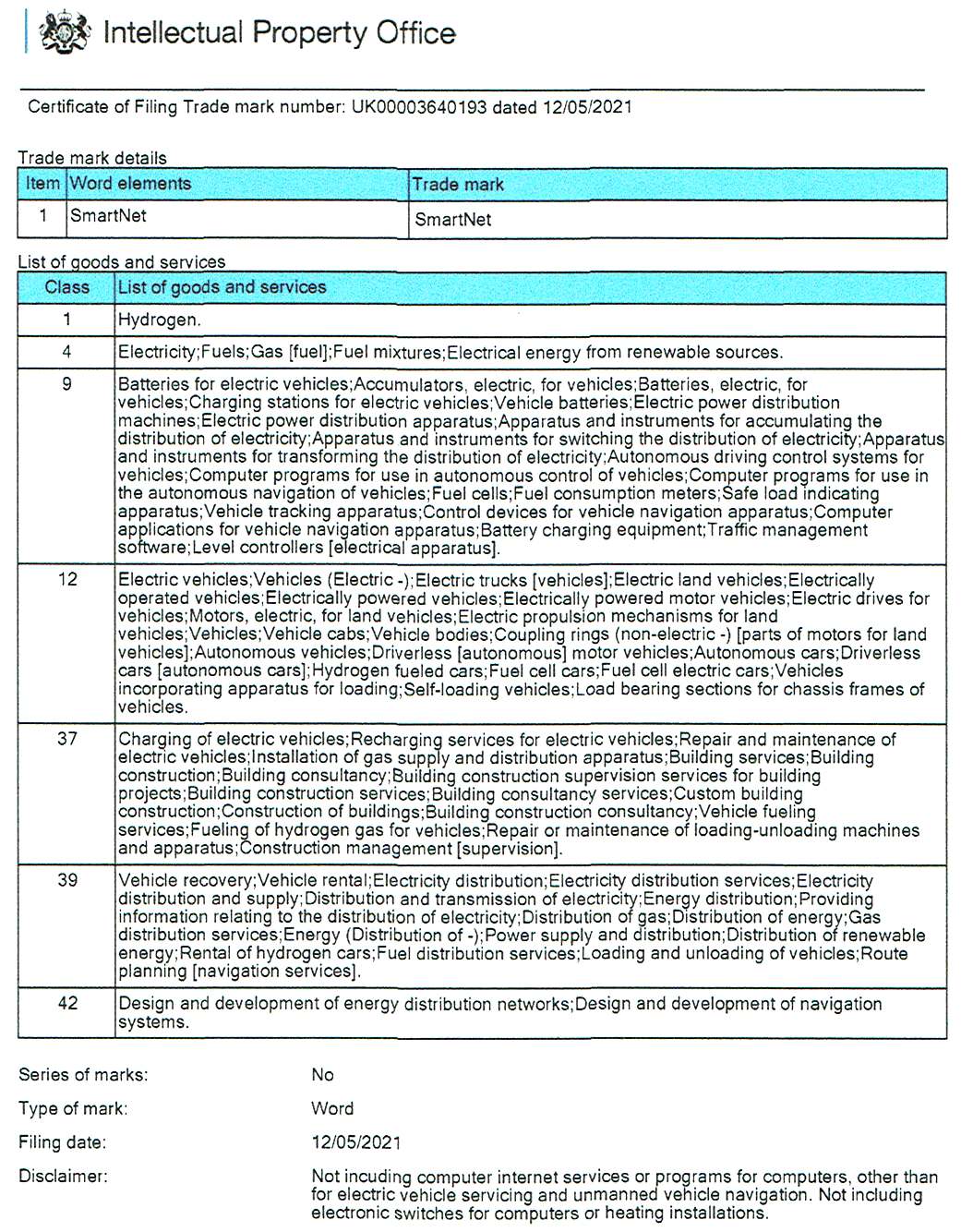

Patents, registered designs, copyright and trademarks are the equalizer for SMEs without a trading track record and the institutional leverage to otherwise obtain grant support. Injunctions based on such IP can, if necessary, block inappropriate encroachment on patents and the like. there is a fast track service for green patents.

Apart from the IP, we can also bring smart software to the table (via an existing contact) and building design and seasoned (real world) planning expertise.

HYDROGEN BOOSTER - The same service station that provides freshly charged 'green hydrogen' batteries, doubles up as an energy store for the national grid of the country concerned, boosting 'green deal' hydrogen production, and reducing CAPEX. That's the beauty of dual fuel capability, multi-function flat-packs making E-Mobility more affordable. This is only a 1:20 scale model. We need your help to get to the full-size demonstration stage, perhaps via a consortium - as a hop-on partner.

These units also supply electricity for conventional rapid (plug-in) charging and hydrogen gas filling - all in one unit - with the kicker being automated energy exchanges for robotrucks and taxis, where there are no people in these autonomous transport chains to effect refills.

The picture above is a 1:20 scale model, so don't get too excited and try to place an order. We need your help to get to the full-size demonstration stage, perhaps via a consortium - as a hop-on partner.

This is a 3.6 - 7.2MW station design at present. You'd need 135 of these beauties to = the 1GW current EU capacity. So 810 units in Europe to satisfy 'Phase 1' (6GW) by 2024. 'Phase 2' would need 5,400 SmartNet™ stations to equal 40GW by 2030. Subject to confirmation during RIA R&D, it could be that these smart service facilities are part of the solution that Europe seeks in meeting their green hydrogen targets.

There are 600,000 fossil fuel stations in the world that need to be replaced to eliminate our reliance on ICE vehicles in the long term. We are not saying we don't need diesel. We need to work with stakeholders to ensure a smooth transition, hoping for the reciprocal.

SEED DEVELOPMENT FUNDING

Our Foundation is an SME, looking to collaborate with academics and industry specialists. We are too small to lead a bid administratively, or make biblical sized applications, but are able to secure and provide IP protection, conceptual project steerage, planning expertise and information dissemination as part of a consortium to support UK or Horizon Europe Cluster 5 or other similarly aligned proposals.

HENRIETTA - thinks she may have something to chirp about. She thinks she may have cracked the 'chicken and egg' conundrum stopping more people enjoying zero emission transport.

POTENTIALLY APPLICABLE CLUSTER FIVE CALLS FOR PROPOSALS:

• HORIZON-CL5-2021-D2-01-08: Emerging technologies for a climate neutral Europe

• HORIZON-CL5-2021-D3-01-05: Energy Sector Integration: Integrating and combining energy systems to a cost-optimised and flexible energy system of systems

• HORIZON-CL5-2021-D5-01-01: Nextgen vehicles

• HORIZON-CL5-2021-D5-01-03: System approach to achieve optimised Smart EV Charging and V2G flexibility in mass-deployment conditions (2ZERO)

• HORIZON-CL5-2021-D6-01-06: Framework for better coordination of large-scale demonstration pilots in Europe and EU-wide knowledge base (CCAM Partnership)

• HORIZON-CL5-2021-D6-01-08: New delivery methods and business/operating models to green the last mile and optimise road transport

• HORIZON-CL5-2022-D2-01-05: Next generation technologies for High-performance and safe-by-design battery systems for transport and mobile applications (Batteries Partnership)

• HORIZON-CL5-2022-D2-01-08: Coordination of large-scale initiative on future battery

• HORIZON-CL5-2022-D2-01-11: CIVITAS 2030 – Coordination and support for EU

WHERE TO START? - Most electric heavy goods vehicles such as long distance trucks and medium range delivery vans, can simply bolt on a kit of parts and be able to travel 700 miles extra between refuelling stops - using one of the proposed (standard) hydrogen batteries - as a bolt on range extender.

With only 14 H2 service stations in the UK in 2021, we hope this may be a topic of discussion at the forthcoming UN COP 26 in Glasgow, Scotland in November 2021.

LOAD LEVELLING SERVICE STATIONS

One of the main reasons that load levelling will become a serious problem, is that we are transitioning from ICE vehicles to electric vehicles. As we do so, EVs will require electrical energy in significant quantities to cope with deliveries of goods and passenger transport.

At the moment there are few service facilities for EVs in terms of hydrogen supply in Europe, In fact it is a non-starter for anyone thinking of buying a hydrogen powered truck. But it is the deliveries of heavy goods that keeps the wheels of commerce turning, hydrogen being seen as necessary to provide the ranges for commercial vehicles. Lithium batteries simply cannot cut it.

Although (in the UK) there is a requirement to provide hydrogen for trucks and fast charging for other EVs, via the Automated and Electric Vehicle Act 2018, the high cost of land in cities and towns presents an obstacle. Especially where the mix of fuel sources is as yet undefined.

It appears that we need Service Stations that can supply hydrogen and electricity cost effectively, by using the land area in a way that is commercially viable in terms of operators. Enter SMARTNET dual fuel service stations - and flat-packs.

We need to replace over half a million (604,937) service stations globally from 2021 to 2035 if we are to contain global warming, meaning that we need to install some 42,200 service stations worldwide - every year - to be able to displace petroleum fumes.

A FREER MARKET - The liberalization of the energy market means the opening of the electricity and gas market to free competition. This has broken up existing monopolies and opened the market to more participants. In most cases, liberalization was accompanied by unbundling, which made a distinction between generation, transmission and distribution/retail in the energy sector. The aim was to make electricity supply more efficient by integrating competitive forces where possible and by integrating regulation where necessary. In Europe, liberalization began in 1996 with the adoption of the first European Directive. The process is not yet complete.

DUAL FUEL VERSATILITY

SmartNet service stations offer electricity and hydrogen supplies to vehicles, and electricity to the grid when loads demand. The secret of the system is in how such a network of versatile stations utilize renewable electricity, to provide hydrogen for transport and store energy for when the grid needs a booster.

This know-how is the subject of patents presently being drafted, for filing at the optimum time to maximise protection for collaborative development and commercial partners, and recovery of development costs. At the moment, the time is not right for such filing, where around 10 years of a 20 year lifetime will be wasted as transitional difficulties are confirmed, not least the possibility of losing advocates (development champions) as they move on the greener pastures. Hence, all collaboration will need to be subject to Non-Disclosure Agreements. Unless, the system is recognised for exceptional funding as (for example) an IPCEI, when patents may be open source.

Utilities are not yet required by law to invest in such crucial development. Neither are vehicle makers. They are running rings around governments whose objectives are to clean up transport and electricity generation, and may do so until we hit Defcon 1 in climate terms, by which time it may be too late for millions of species and billions people.

LOAD LEVELLING, SMART MONITORING & BILLING OR PAY AS YOU DRIVE (PAYD)

To complement the proposed Smart infrastructure load-levelling solution, we will need monitoring and control software to be able to charge for such fuel services, to include taking energy from and returning energy into National Grids at peak demand times, where there will be a premium for providing that service to/for utilities that have so-far failed in that regard.

We anticipate that there may be carbon (tax) credit penalties relating to such failures to perform, or at least there should be, as an incentive to complacency. Comfort is the enemy of progress.

Electrolysers offer a way to convert water into hydrogen and oxygen, now becoming cost effective in terms of comparison with fossil fuels.

GRID NEWS 9 APRIL 2021

European system operators have proposed a set of indicators to monitor the evolution of smart grids at the distribution level, identifying seven key performance indicators (KPIs) for distribution system operators (DSOs) and one common for transmission and distribution operators.

We

note that there is no integration of transport supply, despite this being

one of the most important growth supply areas predicted for the next 9 - 14

years, as Europe transitions from the internal combustion engine, to

electric propulsion.

2 – System controllability: To measure the capability to keep the grid under ‘proper control’.

3 – Active system management: To measure the capability to perform active management of the grid in daily/short-term operation.

4 – Smart grid planning: To measure the capability to use design and planning procedures to fulfil actual grid needs in medium and long-term, guaranteeing cost efficiency in grid updating and the most efficient use of existing assets.

5 – Transparency in data access and sharing between relevant stakeholders: To measure the capability to make accessible and share data between stakeholders.

6 – Local flexibility markets and customer inclusion: To measure how much the customer is involved in grid management and enabled to provide services to the grid and to measure how much the local flexibility market/customer agreements are implemented and how much it can contribute to grid (and system) management.

7 – Smart asset management: To measure the use of advanced asset management strategies, tools and methods focusing on assets condition monitoring and risk mitigation.

The fact that energy for transport has been omitted, indicates the tunnel-vision of utilities, in failing to consider integration. The two articles below from January and February 2021, read in combination appear to be supporting the need for

15

JANUARY 2021 - Europe's distribution grids need €400bn by 2030 says study

Study assumptions include the installation of 510GW of new renewable capacity comprised of 470GW of centralised solar and wind and 40GW of self-consumption. Almost three-quarters is connected to the distribution grids.

Fuel cells provide a way to convert hydrogen gas into electricity, but on their own they do not represent a solution. They are though, an essential ingredient of the mix.

The report, Accelerating fleet electrification in Europe, argues that the region's vehicle fleets hold significant potential for supporting accelerated decarbonisation of transport and should be prioritised.

LINKS & REFERENCE

https://www.enlit-europe.com/news-grids/measuring-the-performance-of-europes-smart-grids

Please use our A-Z to navigate this site, or see HOME

Copyright © Climate Change Trust & Universal Smart Batteries 2022. Solar Studios, BN271RF, United Kingdom.

|