|

PLUG

IN CHARGERS

- For a while plugging in to charge your EVs might be feasible, but as

electrics become more popular, they will soak up energy from the grids that

supply homes, offices and factories, putting an enormous strain on the

present

generating infrastructure. For some reason policy makers,

utilities and vehicle OEMs don't

appear to be able to see that far into the future. Our crystal ball makes

that much plain, without any eye drops. What is needed is Smartnet™

dual-fuel, load-levelling, service stations - mass produced as flatpacks.

WHERE

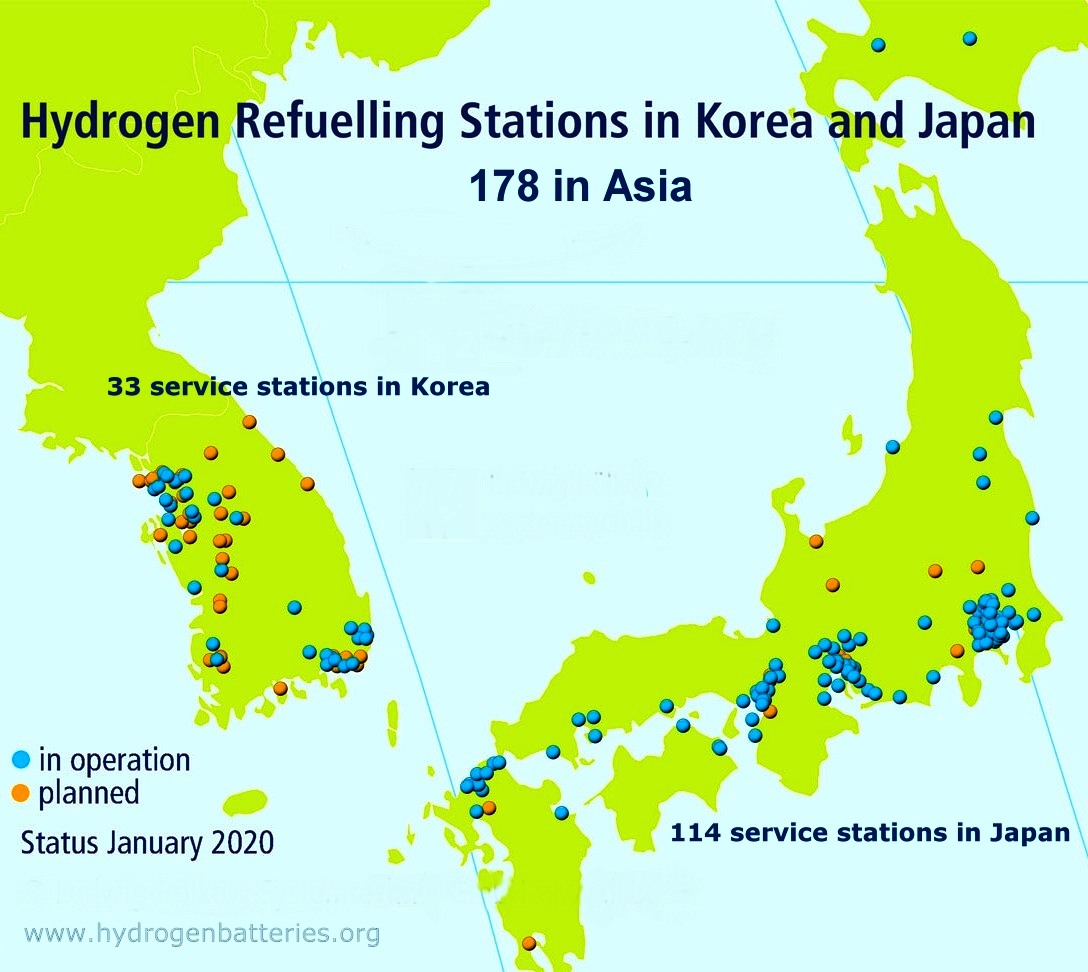

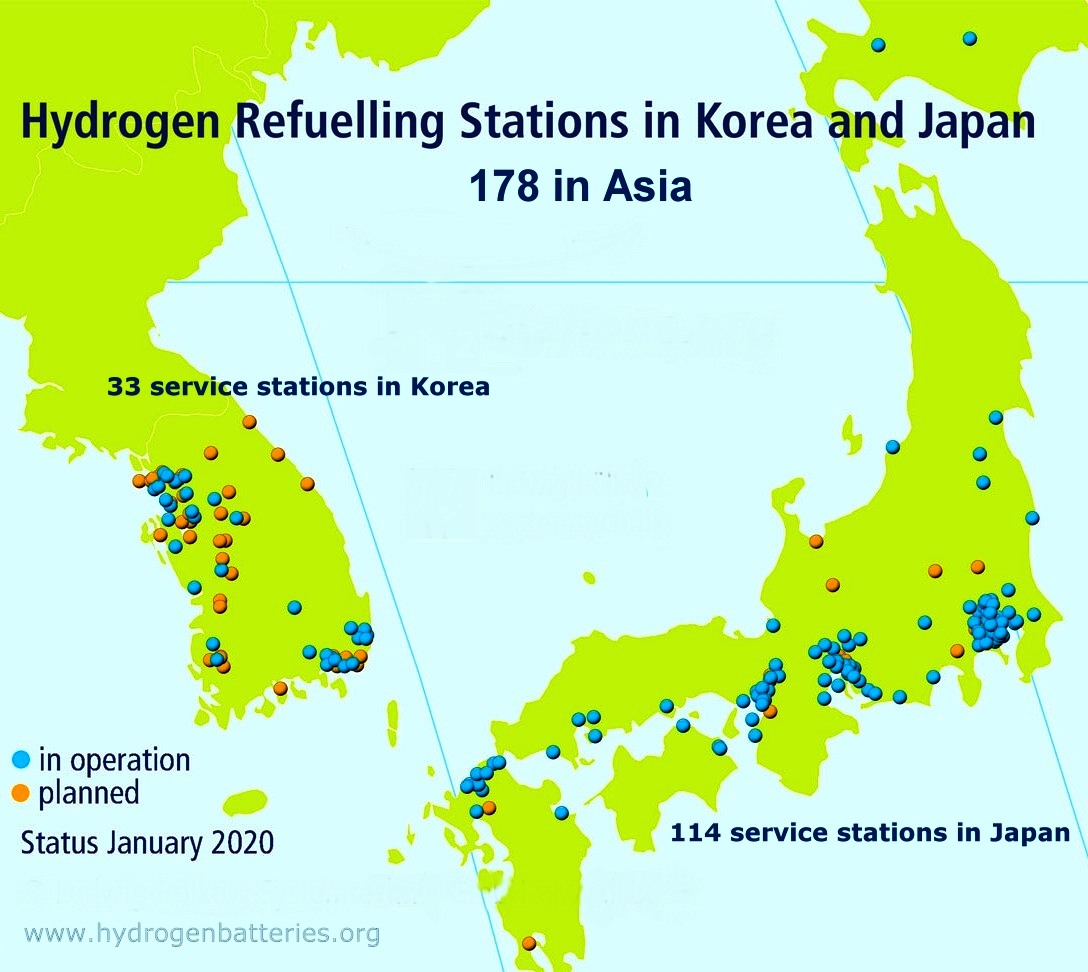

CAN YOU BUY HYDROGEN FOR YOUR FUEL CELL EV ? As

of January 2020 there were 178 hydrogen stations in Asia, 114 of them in

Japan (135 @2021), and 33 in Korea. The

27 Chinese hydrogen stations are used almost exclusively for the refuelling of buses or

fleets of trucks. The most

ambitious near-term growth is anticipated in Korea, where about 40 hydrogen

stations for electric

cars and buses are planned. Meaning that truckers

cannot even think about buying hydrogen

HGVs, because they will be stranded, almost at the point of sale.

The list of hydrogen refuelling stations in Asia @ April 2021

1. Hydrogen

Centre

ONE

SIZE FITS ALL - Well, very nearly. As part of this project we need to

define the physical dimensions of a standard pack, so that it can be stacked to

provide electrical energy for all trucks, and around 90% of cars that at

present use lithium battery packs. Pay

As You Drive technology and smart service stations are the key to

providing an intelligent energy mix for EVs.

NIKKEI ASIA DECEMBER 23 2020

TOKYO -- While it looks like any other filling station in Japan, the Iwatani Hydrogen Refueling Station in the Shibakoen neighborhood of Tokyo is distinguished by three things: the large "H2" on the pumps, an absence of any smell of gasoline, and the lack of very many customers. Five cars in one hour were considered exceptional, according to one station employee last Wednesday.

And this was one of the busier days he had seen, at one of the busiest hydrogen refueling stations in Japan. "Generally speaking, other stations average around three drivers per day, but here we see 30 customers," said the employee, who asked that his name not be published as he was not cleared to speak to the press.

Shibakoen is an upscale Tokyo neighborhood of government ministry buildings and wealthy residents. This explains the relatively high demand for hydrogen fuel: Many of Japan's fleet of 3,757 hydrogen-powered vehicles are government-owned. The rest are bought by wealthy, environmentally conscious enthusiasts who can afford 7 million yen (around $68,000) -- 6 million yen with a government subsidy -- for a midsize, carbon-neutral sedan.

While the traffic is a small fraction of daily numbers at a normal gasoline filling station, the station employee said he was not deterred. Optimism about the future of hydrogen was why he enrolled in a mandatory three-month training course before taking this job. "I really feel the potential of next-generation energy -- that's why I chose to work in this business. Hydrogen is something unique. I was attracted to the possibility of the national project," he said.

Japan currently boasts the largest network of hydrogen filling stations in the world. There are 135 stations in all -- heavily subsidized -- which symbolize the government's faith in the future of hydrogen and its effort to lead the world in the race to commercialize it.

The showcase for Japan's utopian "hydrogen society," as the government refers to its future plans, was to be the Tokyo Olympics originally scheduled for this year. Canceled over the COVID-19 pandemic, it is now due to be held next summer. Part of the Olympic Village, known as Harumi Flag, was to be equipped with fuel cells using hydrogen to generate electricity for lights and air conditioning, while visitors would be transported to various parts of Tokyo with hydrogen-fueled buses.

Life in the hydrogen society does not have to be drastically different, said Kenichiro Ota, an emeritus professor at Yokohama National University who has been involved in hydrogen research since the 1970s. "It would be perfect if everyone could use hydrogen safely and without knowing it."

Japan's infatuation with hydrogen dates back to the oil shock in the 1970s when it was extensively researched as part of a green-energy initiative known as the Sunshine Project, which also included

solar and

wind

power.

Since then, the government has been investing steadily in the new technology. This year, for example, the government has a budget of 70 billion yen to promote hydrogen, with the Ministry of Economy, Trade and Industry requesting 84.8 billion yen for the next fiscal year starting in April. Over 30 billion yen of that is allocated for subsidizing purchases of hydrogen fuel cell vehicles and for setting up hydrogen stations like the one in Shibakoen.

In 2014, Japan led the world with the first commercial hydrogen vehicle, the Toyota Mirai (meaning "future" in Japanese). Honda Motor followed with the launch of Clarity Fuel Cell in 2016, and this month Toyota launched a highly anticipated new iteration of the Mirai.

Meanwhile, the most imposing example of Japan's confidence in hydrogen lies in the port town of Kobe in western Japan, where the world's first hydrogen carrier, the towering 116-meter Suiso Frontier, lies at anchor. Built by Japan's Kawasaki Heavy Industries and launched last year, the ship is the first in the world designed to carry hydrogen -- kept at an extremely low temperature of minus 253 C in order to be compressed into liquid form. It is set to start shipping hydrogen from Australia to Japan in 2021.

By 2030, Kawasaki Heavy aims to have two ships ready to bring 225,000 tons of hydrogen to Japan, enough to power 3 million fuel cell vehicles for 10,000 km every year.

Japan sees hydrogen as important not just for reducing carbon emissions, but also in terms of energy security. Japan is heavily dependent on oil shipped from the Middle East and via sea lanes in the

South China

Sea. Adding to the complexity of the energy puzzle is an unofficial ban on new nuclear power plants since the Fukushima disaster in 2011.

"It is important to diversify where to source the energy from, because Japan is poor in resources," said Toshiyuki Shirai, head of the hydrogen and fuel cells strategy office at METI. Hydrogen is attractive because it can be produced from various resources, from fossil fuel to wind or sunlight, and can be imported from anywhere, unlike electricity.

Electric blues

Critics of hydrogen focus on the cost. Fuel cells are "fool cells," as Tesla's founder Elon Musk put it, calling hydrogen-powered cars a "mind-bogglingly stupid" idea. Tesla, which produces battery-powered cars, sees hydrogen fuel cells as a competing technology.

It continues to fall in price, but not fast enough for skeptics. METI estimates that the cost eventually needs to come down to 20 yen per normal cubic meter for hydrogen to be commercially viable, almost on par with liquefied natural gas. In 2017, it was 100 yen per cubic meter -- five times as high as it needs to be.

And even with subsidies of over 1 million yen per vehicle, fuel cell vehicles are an expensive choice. Toyota's Mirai, which launched this month, is priced (without subsidy) from 7.1 million yen --- twice as expensive as the electric Nissan Leaf, at 3.3 million yen. Filling up the Mirai's tank costs 6,776 yen to drive 850 km, while it costs a fraction of that -- up to about 1,860 yen -- to fully charge a Nissan Leaf, which has a shorter driving range of about 570km.

The drawback with the Leaf is that charging takes up to about one hour, while the Mirai takes only 3 minutes.

Even advocates admit that hydrogen may not ever be the most efficient way to power light vehicles. Hydrogen is best at some things but functions when there is a division of labor between fuels, say some experts.

In terms of technology, "it is not about which one wins," said auto analyst Takaki Nakanishi, head of the Nakanishi Research Institute. "Fuel cells are for large and long-range [transport], and electric vehicles are more efficient when it comes to small and short-range."

Batteries, for example, are generally large and cumbersome when it comes to storing large amounts of energy. Fuel cells can be more compact and are also more suited to longer-term storage -- weeks, or even years.

So, hydrogen is seen as a key factor in the green economy, because it could fill the gap as an alternative fuel in sectors that have been hard to electrify with renewable energy, such as steel production and mass transport.

Japanese multinational Toshiba, for example, is eyeing demands for its fuel cells in railroads and ships, said Yoshihisa Sanagi, general manager for hydrogen energy business at Toshiba Energy Systems & Solutions.

Another possibility is power stations. "To achieve mass use of hydrogen, it needs to be used for power generation," said Masashi Nagai, general manager of hydrogen supply chain development at Japanese engineering company Chiyoda. "Only after that, there would be a bigger hydrogen market for different demands," including passenger cars, he suggested.

Finding the chicken

Optimists insist that fuel cell vehicles are just as viable as electric vehicles and that solving the cost issue is mainly a matter of scale. The current government target says that the economically viable 20 yen-per-cu.-meter level is possible with a large enough market: 10 million tons of hydrogen per year, the government says. Nikkei recently reported that the government is considering speeding up its efforts in order to reach that level by 2030.

Ahead of rolling out its new Mirai this month, Toyota's Chairman Takeshi Uchiyamada said at a launch event of Japan's Hydrogen Association:

"It is similar for all technologies. When technologies are first introduced into society, the initial cost is inevitably high because we have to ensure quality and safety. Going through that experience fast brings down the cost."

Building the Mirai was an act of faith in Japan's commitment to hydrogen, he said. "It is not like in the past, when it became widespread if manufacturers worked hard to create an attractive product at low cost. Society, as a whole, has to work on building the infrastructure like electric cars filling stations or fuel cell vehicle filling stations ... or on logistics and creating the market in order to increase the volume [of hydrogen]. So, that is why we are aiming for the hydrogen society together."

Drivers interviewed at Iwatani's refueling station said they liked their hydrogen fuel cell cars, such as the Mirai, but the biggest drawback was the lack of filling stations. Meanwhile, the limitation on filling stations is plainly due to the lack of cars.

"It's a chicken-and-egg

problem, and Mirai was supposed to be the chicken," said Nakanishi. Hopes that the first generation of hydrogen cars would be the catalyst for a wave of hydrogen have proved a disappointment. Now, the same ambitions have been transferred to the new Mirai.

"The first Mirai triggered that first wave, but the result of it was not as great as originally anticipated. [The industry] did not blossom," he said. "Hydrogen is that difficult."

As of March, Japan had just 3,757 fuel cell passenger vehicles, but the government plans for this to rise to 200,000 by 2025. That would put the market on par with EVs, currently 123,717. There are a total of 10.9 million new-energy vehicles in Japan if hybrids are included, according to the Next Generation Vehicle Promotion Center, a Tokyo-based industry body.

Japan is counting on more customers like Nobuyuki Ogawa, a man in his 50s who stood at an Iwatani station having his vehicle's tank filled by an attendant in crisp workwear. He had taken the day off to rent a fuel cell car to see whether he liked it. "This is the first time I've found a Japanese brand I really want to drive," he said.

He was not the only one who felt the pull of an eco-friendly vehicle. "I was trying to make a booking and it was almost full." He remarked, "It's very comfortable to ride, it's silent, there is no noise, and is very smooth when I start running."

Another driver visiting a filling station in the Shibakoen neighborhood, a civil servant in his 40s, said the fuel cell vehicle he was driving was a government car rather than his own. "I hope fuel cell vehicles will become more common, but there are not many stations ... that's the obstacle," he said.

Then there is still the price. "If you look at a hydrogen station, you can see it is very expensive," Nakanishi pointed out -- attributable to the costly equipment required to handle and store the fuel.

A batch of large Japanese companies are hoping to reserve a share of the future hydrogen market. One is engineering company Chiyoda, which teamed with Nippon Yusen for what they call "the world's first global hydrogen supply chain demonstration," a project that took off this year.

Chiyoda's system adds the chemical toluene to hydrogen, creating a more stable substance. That makes it able to be transported and stored with existing technology used for petroleum products. Unlike liquefied hydrogen, the liquid needs to go through a process of removing toluene before being used, for example, in fuel cells.

The process is less technologically complex than liquification. Transporting hydrogen stabilized with toluene can be done with a normal ship used to transport chemical products. Liquefying hydrogen is costly because it is very difficult to keep hydrogen at minus 253 C.

Chiyoda used hydrogen produced in Brunei using waste gas from a natural gas plant, carried in a tanker in three round trips between Brunei and Japan to supply a total of about 110 tons of hydrogen. That amount would fill an empty Mirai about 20,000 times.

Another market entrant is Toshiba, which has been doing research on fuel cells since the 1960s and claims to lead in hydrogen technology. Alongside companies such as Iwatani, the gas supplier, Toshiba developed a solar power farm and a 10-megawatt facility for producing hydrogen from renewable energy. The project was based in Fukushima, the prefecture that in 2011 was hit by a devastating tsunami and the nuclear disaster.

The facility was launched earlier this year at a site that was heavy with symbolism: It was originally reserved for a new nuclear power plant.

First-mover advantage

2020 might be hydrogen's moment. While Japan was the first to place a big bet on the fuel, other countries just this year have begun to notice the potential. The next few years will show whether Japan's early lead in the technology will remain intact.

In Asia, South Korea's 160 trillion won ($145 billion) New Deal economic strategy announced this year included the provision of 200,000 hydrogen vehicles and 450 charging facilities by 2025. South Korea's Hyundai Motor began production of a hydrogen-electric car in 2013 and launched the Nexo fuel cell car in 2018. The 2018 Pyeongchang Winter Olympics, meanwhile, showcased a hydrogen bus. In the future, the company looks to use hydrogen to fuel trains and flying cars.

China, which has been heavily subsidizing its electric-vehicle industry, is also going big in fuel cell vehicles. It has a 2030 target to increase their number to 1 million and to reach 1,000 hydrogen refueling stations.

The country is setting up model cities and subsidizing companies developing hydrogen-related technologies. Chinese combustion engine company Weichai Power bought shares of Canadian fuel cell company Ballard Power Systems in 2018, and together they created a joint venture to manufacture fuel cells for buses, trucks and forklifts.

The German government, for its part, announced a target in June of achieving 5 gigawatts of renewable generation capacity by 2030 to enable the production of green hydrogen. It plans to spend 7 billion euros to support the market rollout of hydrogen technology and another 2 billion euros for fostering international partnerships. The European Union followed in July, announcing a strategy to install at least 6 gigawatts of electrolyzers -- equipment to break up water into hydrogen and oxygen, using electricity -- by 2024 and 40 GW by 2030.

Takeshi Kaneda, president of consultancy Universal Energy Research Institute, criticized Japan's investments in hydrogen for being led by large companies that do not move quickly with the new technology. Other countries are catching up.

"It takes a decade for [Japanese companies] to launch a commercial product," Kaneda said. "In the meantime, the rest of the world becomes powered by hydrogen led by [companies that started out as] startups," he added. He referred to the U.S.-based Plug Power, which provides fuel cell and on-site hydrogen stations for forklifts, as one of the success cases. Its customers include Walmart and Whole Foods, as well as carmakers such as BMW.

Green, blue, or gray?

Hydrogen releases no carbon when burned -- the only emission is water vapor. But the process of producing hydrogen from fossil fuels, such as brown coal, is dirty.

In order for hydrogen to be really "clean," it needs to be produced from renewable energy, or from fossil fuels combined with carbon capture technology to extract

greenhouse

gases. Hydrogen from renewables is often called green hydrogen. Hydrogen from

fossil fuel is "gray," or blue if combined with carbon capture and storage.

Japanese companies like Chiyoda say that they are aiming for either blue or green hydrogen. However, for the moment, they say they will also use gray hydrogen -- which is much cheaper -- in an effort to jump-start the market.

In the case of Kawasaki Heavy's project with Australia, hydrogen is produced out of cheap brown coal. By turning the coal into hydrogen, it becomes a transportable resource. Australia's Victoria state is currently trying to develop a commercial-scale carbon capture and storage network.

This has been criticized as unrealistic by experts. "If the Japanese government wants to promote non-green sources of hydrogen, then it needs to not promise carbon capture in the future, but carbon capture has to be a requirement for any commercial project," said Llewelyn Hughes, associate professor at the Crawford School of Public Policy at Australian National University.

"You need to price that cost of carbon capture and include that cost in the project cost. ... I think it is pretty certain that, in the future, green hydrogen will be a much cheaper option."

According to Kawasaki Heavy, it is aiming for a hydrogen cost in line with the government target of 30 yen per cu. meter, with carbon capture, by 2030. The company also recently announced that it would work on another potential supply chain project to transport green hydrogen from Australia.

Tomas Kaberger, chair of the Renewable Energy Institute's executive board, was more blunt: "In Japan, there are ideas such as importing hydrogen produced from fossil fuels, with carbon capture and storage in other countries, which will never be economically sensible."

In the long term, hydrogen can be useful in some sectors, said Hughes. But he also suggested: "We have very good technologies now that can rapidly decarbonize

electricity. ... Our main focus right now should be on deploying renewable energy."

Japan is planning to revise its energy strategy next year. The current energy mix goal for 2030 holds that renewables should account for more than 22% of total electricity demand, which is often criticized as too low. Without a medium-term goal, "the risk is that you end up subsidizing a lot of different technologies [including the hydrogen-related ones]" without the "outcomes that you need" to go green, said Hughes.

Hydrogen is also not the only technology option for reducing emissions. Shigeru Muraki, representative director of the Green Ammonia Consortium and former vice president of Tokyo Gas, said Japan is falling behind other countries in the use of pure hydrogen. But he also suggested that ammonia would be a more cost-effective option, even when combined with carbon capture.

"Japan can still compete in the world for [the technology to use] ammonia and can lead in Asia," Muraki said. Ammonia is a compound of nitrogen and hydrogen and does not emit carbon dioxide when burned. It can more easily be liquefied than hydrogen and can be handled using existing infrastructure and technologies, which means lower costs.

This could spark a new ammonia race, even before the hydrogen race has started.

NPR MARCH 18 2019

It may feel as though the electric car has been crowned the future of transportation.

Auto companies have plans to make more electric car models, and sales — still only a tiny fraction of the overall market — are expected to get a boost as more countries pass regulations to reduce carbon emissions. But Japan isn't sure that the battery-powered electric car is the only future, and it's betting big on something it says makes more sense in big cities: hydrogen fuel cell vehicles.

At the LFA Works factory in the city of Toyota, Aichi prefecture, workers install carbon-fiber hydrogen tanks on Toyota's new hydrogen powered fuel cell car. It's called the Mirai, which means "future" in Japanese.

A hydrogen fuel cell doesn't burn anything. It uses a chemical reaction between the hydrogen and the oxygen from the air to produce electricity. Hydrogen fuel cell cars are quiet, like battery electric ones, and they emit only water.

At this tiny factory, located inside Toyota's larger Motomachi plant, only about 10 cars are made each day, assembled by hand.

"I love Mirai," says plant manager Matsuo Yoshiyuki, who owns one of the vehicles. "I believe in the future of hydrogen. It's very important for the [environment]."

Only about 11,000 fuel cell vehicles are on the road worldwide. Nearly half of them are in California, which has stringent vehicle emission regulations and tax credits that incentivize electric and fuel cell vehicles.

In Japan, the Mirai is expensive even with a generous government subsidy that brings it down from the equivalent of about $70,000 to about $50,000. The largest cost is the fuel cell production, but Toyota says that will drop as production ramps up.

Japan has embraced the technology and aims to create the first "hydrogen society," which also includes the use of hydrogen for power generation. The energy ministry has ambitious targets in the lead-up to the 2020 Olympics. The city of Tokyo plans to deploy 100 hydrogen fuel cell buses during the games, and it wants to have 40,000 fuel cell electric vehicles on the road, with a longer-term goal of 200,000 such vehicles in the next six years.

More convenient than plug-in electric

Today there are far more battery electric vehicles on the road than hydrogen cars, with more than 5 million plug-in cars worldwide, according to José Pontes, an analyst at EV-Volume.com, a website that tracks the industry. But in countries like Japan, where much of the population lives in dense urban areas, many people live in apartment buildings without a place to easily charge a car. It's here where companies like Toyota are banking on the convenience of the hydrogen fuel cell.

"There's just no behavior change as long as you have [hydrogen] infrastructure in place," says Matthew Klippenstein, co-author of the online publication Fuel Cell Industry Review. "We go to the same gas station and fuel up in the same few minutes and just keep on tootling on."

In South Korea, where the majority of residents also live in urban areas, automaker Hyundai just announced that it plans to produce 700,000 fuel cell cars a year by 2030.

Klippenstein likens the divide between hydrogen fuel cells and battery electric plug-ins to the gasoline and diesel split familiar to American consumers. "We will see a similar split where batteries will, for decades at least, dominate the light duty vehicle passenger cars," he says, "whereas fuel cells will ultimately win out in the heavier applications."

Meanwhile, Japan is investing heavily to create the infrastructure needed to promote hydrogen vehicles. It is tough to sell a hydrogen car without a lot of places to fill it up. But without more cars on the road, such fueling stations are not a smart investment for private companies.

So the Japanese government has stepped in with subsidies. The country, along with private companies like Toyota, has helped build and operate 100 hydrogen fueling stations so far. Japan has a target of 900 by 2030. By then, Toyota hopes there will be enough hydrogen vehicles to make the stations profitable.

Not necessarily carbon-free

Another advantage of hydrogen could be reducing Japan's heavy reliance on Middle East oil. Hydrogen is abundant, and the fuel could be produced anywhere. But producing hydrogen fuel is itself energy intensive, and — just as with battery

electric vehicles — it might be produced using natural gas or coal.

"So it's not really clean if that is the case," says Kimiko Haraka of the Kiko Network, a Japanese environmental group.

Haraka is critical of a plan by a number of Japanese companies, including Kawasaki Heavy Industries, J-Power, Iwatani Corp. and Marubeni, to build a plant in Australia that would use lignite coal to produce hydrogen for

fuel cell vehicles. She also worries that the many subsidies for hydrogen come at the expense of promoting renewable energy.

Still, Bertel Schmitt, a former car industry advertising executive who lives in Tokyo, says it makes sense for Japan and its automakers to include hydrogen vehicles in their long game plan.

"They pretty much realize that the exhaust regulations will get tougher and tougher," he says. "What is being enacted right now, in 2020 in Europe, is nothing compared to what will come five years later, 10 years later."

For now, though, Schmitt says the internal combustion engine remains the cheapest and most convenient car on the market. Despite massive investment, he says Toyota knows hydrogen won't be taking over the roads anytime soon.

"They know that the guy sitting in the hydrogen fueling station will be very, very lonely for quite a while."

LOSS

MAKERS - They are losing money hand over fist, but Japan's hydrogen

filling stations, like this one in Tokyo, are subsidized for the wealthy few

who can afford a luxury fuel cell car. We want to make all EVs cheaper, BEVs

or FCEVs,

with especial focus on making commercial vans and trucks zero

emission.

MARCH 2018 REUTERS (TOKYO)

An alliance of 11 Japanese firms, including automakers and energy firms, has pledged to build 80 fuelling stations for hydrogen fuel cell vehicles by 2022 to help accelerate take-up of the next-generation fuel technology.

Japan H2 Mobility LLC, whose backers include Toyota Motor Corp and JXTG Nippon

Oil & Energy, said on Monday it would oversee the construction and operation of the new fuelling stations, nearly doubling the number at present.

As countries seek low emissions energy sources to power vehicles, homes and industry, Japan is betting heavily on becoming a “hydrogen society” despite the high costs and technical difficulties of a process that creates electricity from a chemical reaction of fuel and

oxygen.

JXTG Nippon Oil Senior Vice President Yutaka Kuwahara said on Monday that a lack of users and high costs to build and operate fuelling stations had slowed construction in Japan, delaying a government target to build 100 stations by March 2016.

Japan currently has about 90 stations, with at least 40 operated by JXTG Nippon Oil, and another 10 are in the planning or construction stage.

“We must lower costs, which will remove many of the bottlenecks to developing more stations,” he told reporters at a briefing.

By about 2020, the Japanese government aims to roughly halve the cost of building a hydrogen fuelling station, which is currently about 400 million yen to 500 million yen ($3.8 million-$4.7 million), well above 100 million yen for a gasoline station.

The path to adopting hydrogen has been dogged by the difficulty in driving widespread take-up given high costs of fuel-cell vehicles (FCVs), limited production capabilities and low numbers of fuelling stations.

Only a handful of automakers currently market FCVs, including Toyota,

Honda Motor Co and

Hyundai Motor Co. Toyota has sold only 5,300 units of its Mirai FCV since its launch in 2015, while it has sold a total of around 11.5 million gasoline hybrids since launching the Prius 20 years ago.

LINKS

& REFERENCE https://www.reuters.com/article/us-japan-hydrogen-idUSKBN1GH072

https://www.npr.org/2019/03/18/700877189/japan-is-betting-big-on-the-future-of-hydrogen-cars?t=1620000973462 https://asia.nikkei.com/Spotlight/The-Big-Story/Be-water-Japan-s-big-lonely-bet-on-hydrogen

Please

use our A-Z

INDEX to navigate this site

This

website is copyright © Climate Change Trust 2021. Solar

Studios, BN271RF, United Kingdom.

|