|

HYDROGEN

BOOSTER - The same service station that provides freshly charged 'green

hydrogen' batteries, doubles up as an energy store for the national grid of

the country concerned, boosting 'green

deal' hydrogen production, and reducing CAPEX. That's the beauty of dual

fuel capability, multi-function flat-packs making E-Mobility more

affordable. This is only a 1:20 scale model. We need your help us to get to the

full-size demonstration stage, perhaps via a consortium - as a hop-on

partner.

Assuming

we pass through feasibility (proof of concept) and subsequent R &D

Actions to a full size demonstrator, this technology could be fully

commercialized via a parent (holding company) such as the proposed:

"Universal

Smart Batteries Ltd" for the express purpose of capitalization. This

significant step is likely to be necessary only if stakeholders do not seek

development licences. Partners

in any development consortium preceding such commercialization will be

entitled to purchase shares in the IP holding company, as recognition of

their part in the development of know-how and proving of the technology. The decision for a private company to ‘go public’

is typically based on a number of factors. An Initial Public Offering (IPO)

in this case more than likely the the London Stock Exchange’s AIM, an admission to trading by way of

placing, may provide a private company with enhanced access to capital and liquidity and increase its public profile. It will also create an acquisition currency for the company to use in future transactions, which is an increasingly important consideration for companies as they look to accelerate growth.

When a company has decided to conduct an IPO, it will be faced with the decision of where to list.

Being in the UK, London has long been considered one of the preeminent locations for a company considering listing its shares on a public market.

London’s equity markets are comparatively sector-agnostic and attract companies from a broad range of industries.

The UK Government has made a large number of changes to UK law to include EU

law, including in relation to the prospectus, listing, transparency and market abuse regimes, and these changes will take effect from the end of the transitional period. These are designed to ensure that, in the absence of some new legal and regulatory relationship with the EU taking their place, those regimes will continue to operate effectively and broadly in line with the way in which they operated before the UK left the EU.

PROSPECTUS REGULATIONS

The other significant development in 2019 affecting UK IPOs has been the full implementation of the new EU prospectus regime established by the new, directly applicable Prospectus

(Admission Document) Regulation with effect from 21 July 2019.

The most significant changes brought about by the new Prospectus Regulation,

as reflected in the ‘on-shoring’ of the prospectus regime following the end of the UK’s Brexit implementation period,

and of particular relevance to IPOs (as opposed to secondary offerings) include:

• More prescriptive rules on the disclosure of risk factors in prospectuses. •

Length and a Q&A format •

The ability of certain small and medium-sized enterprises (“SMEs”) and other small issuers whose securities are not admitted to trading on a regulated market to issue an ‘EU Growth prospectus’ which

contains lesser information than a full prospectus. •

The ability to be able to incorporate by reference in the prospectus a wider range of information. Following the full implementation of the Prospectus Regulation, the FCA has replaced much of the content of the Prospectus Rules in its Handbook (which also contains the FCA’s Listing Rules, Transparency Rules and disclosure requirements with respect to the Market Abuse Regulation ((EU) 596/2014) (“MAR”) (together, the “Listing, Transparency and Disclosure Rules” or “LTDRs”)) with appropriate extracts from the relevant, directly applicable EU regulations.

MARKETS

The first step for a company considering listing in London will be to determine which market is right for it.

The LSE operates two principal markets: the Main Market; and AIM, both of which are relevant to IPOs.

AIM is the preferred London market for smaller and/or growth companies whose securities are not ‘officially’ listed.1 It operates a less prescriptive regulatory and governance regime than the regime that applies to companies admitted to trading on the Main Market, which is considered to be more appropriate for the stage of development of these types of companies. AIM

will also be more attractive for companies that will have a small free float as there is no formal minimum free float requirement on AIM, whereas companies seeking admission to the Main Market will ordinarily need at least a 25% free float. Under MiFID II it operates as a multilateral trading facility, rather than a regulated market, and currently qualifies as an EU SME Growth Market (which confers on companies traded on such markets certain relaxations under the EU’s prospectus and market abuse regimes).

ADVISERS & PARTIES

When deciding on which market to pursue its IPO, a company will need to engage with its legal and financial advisers at an early stage to determine whether it will satisfy the eligibility criteria of its chosen market. The advisory team will consist of at least the following:

• Sponsor/Nominated Adviser/financial adviser: For companies seeking a premium listing on the Main Market, they will need to appoint an investment bank or other institution authorised by the FCA to act as the company’s sponsor (the “sponsor”) in accordance with the Listing Rules published by the FCA (acting in its capacity as the UK’s securities regulator (and formerly under the name of the UK Listing Authority or the “UKLA”, a term which the FCA is now phasing out). The sponsor’s role is to advise the company on the application of the Listing Rules and the PRRs, and to make a declaration to the FCA shortly before admission confirming that: (i) the sponsor has acted with due care and skill; and (ii) the sponsor’s reasonable belief with respect to a number of matters relating to the company’s suitability for listing. The company will also be required to appoint a sponsor after it has been admitted to trading in relation to certain transactions and other matters where the application of the Listing Rules needs to be taken into consideration.

In February 2019, the FCA issued important new and updated guidance with respect to sponsors and their responsibilities under the Listing Rules.

The Nominated Adviser (“Nomad”) is broadly the equivalent of a sponsor on AIM; however, the key difference is that a Nomad’s appointment is full time, acting as an interface between the LSE and the AIM company and providing regulatory advice to the company on an ongoing, rather than ad hoc, basis.

Companies seeking a standard listing on the Main Market will not be required to appoint a sponsor or Nomad, but will ordinarily appoint a financial adviser to assist them with matters such as structuring, valuation, marketing and transaction management.

• Underwriters: The company will appoint at least one bank, who may also be the sponsor, to lead the offering of shares to investors (known as the ‘global coordinator’). A wider syndicate of banks may then be appointed by the company and the global coordinator to implement the offering.

• Reporting accountants: The accountants will assist with ensuring that the company has sufficient and up-to-date financial information to meet the requirements of the PRRs and Listing Rules, in the case of a Main Market IPO, or the AIM Rules for Companies, in the case of an AIM IPO. Other key work streams for the reporting accounts will be preparing a detailed due diligence report on the financial position of the company’s group (known as the ‘long form report’), confirming that there has been no significant change in the financial position of the company since the date of its most recently audited accounts, preparing reports on the adequacy of the company’s working capital and, in the case of a premium listing, the directors’ ability to make proper judgments on an ongoing basis as to the financial position and prospects of the company’s group, and their capitalisation and indebtedness.

• Legal advisers: The company’s legal advisers will assist with the structuring of the group, detailed legal due diligence and the preparation of relevant disclosure, advising on the corporate governance for the group, advising on the implications of the Listing Rules, PRRs and other relevant laws and regulations to the IPO, and preparing the principal transaction documentation, including the prospectus.

UNDERWRITING

Ordinarily, a UK IPO will be underwritten on a ‘reasonable endeavours’ basis, whereby the banks agree to use reasonable endeavours to procure placees for the shares being offered. If

the banks are unable to procure placees, they will have no obligation to take up the shares

themselves, where most UK IPOs are also conducted on a book-built basis, where investor

enthusiasm for the offering is gauged before pricing is confirmed, the banks will ‘build the book’ prior to signing the underwriting agreement, giving the banks and company clarity on how many shares

will be soaked up.

APPLICATION PROCESS

At the final stage of the IPO process, the company will follow the formal admission requirements set out in the LSE’s Admission and Disclosure Standards (“ADSs”) Rules 2 to 6 of the AIM Rules for Companies, in the case of an AIM IPO.

The ADSs require that an issuer contacts the LSE no later than 10 business days before the application for admission is to be considered, using a prescribed form titled

‘Form 1’ and accompanied by a draft copy of the prospectus. The application will, however, be considered provisional at this stage and will only be deemed to be a formal application once the prospectus has been approved by the FCA.

ADMISSION TO TRADING

In the case of an AIM IPO, the Listing Rules and the ADSs will not be applicable. Instead, applicants will be required to comply with the AIM Rules for Companies published by the LSE and their Nomads with the LSE’s AIM Rules for Nominated Advisers. The PRRs will generally not be relevant to an AIM IPO, since it will usually be structured so as to avoid being an ‘offer to the public’ under FSMA (i.e. it will be an offer which, under the Prospectus Regulation, is exempt from the obligation for a prospectus to be published because it is only made to ‘qualified investors’ (e.g. institutional investors)).

PROSPECTUS DISCLOSURE - AIM ADMISSION DOCUMENT

For companies seeking admission to AIM, the content requirements for their admission document are set out in Schedule Two of the AIM Rules for Companies, which are based on the content requirements for a prospectus but with certain variations. For example, an OFR will not be required, but a prescribed disclaimer on the nature of AIM being a market for emerging or smaller companies will. Schedule Two also contains a general disclosure requirement that the company includes any other information which it reasonably considers necessary to enable investors to form a full understanding of the assets and liabilities, financial position, profits and losses, and prospects of the applicant and its securities for which admission is being sought, the rights attaching to those securities and any other matter contained in the admission document.

In the case of a company seeking admission to AIM (assuming that they do not conduct an ‘offer to the public’) and in which case the key disclosure document is an ‘admission document’, rather than a 'Prospectus.'

The Admission Document should be written in an easily analysable, concise and comprehensible form and to contain the necessary information which is material to an investor for making an informed assessment of the financial position, etc. of the issuer, the rights (patents, trademarks and designs) attaching to the securities being offered and the reasons for the issue and impact on the issuer. It may be published in a single document (which is the typical UK practice).

MAR OBLIGATIONS

the most significant change for a listed company (or an AIM-traded company) is likely to be its increased disclosure obligations and the control of ‘inside information’.

AIM-traded companies are subject to an additional ‘price-sensitive information’ disclosure obligation that overlaps with their MAR disclosure obligation.

SPECIALIST COMPANIES

Additional disclosure obligations apply to scientific research-based companies, and also property companies, as ‘Specialist Issuers’ under ESMA’s update of the Committee of European Securities Regulators (“CESR”) recommendations on the consistent implementation of Commission Regulation (EC) No. 809/2004 implementing the Prospectus Directive (ESMA/2013/319) (the “ESMA Recommendations”).

The Listing Rules also contain a small number of variations for scientific research-based companies from the normal eligibility requirements of a premium listing. As already mentioned, such companies will not be required to produce three years of historical financial information if they have been operating for a shorter period,8 in which case the three-year track record requirement referred to above will be reduced to the period for which the company has published financial information.

SHAREHOLDER AGREEMENTS

While investor education is progressing, all further IPO documentation will need to be completed.

A relationship Agreement is not necessary for an AIM offer. But it may be an

advantage to have a Shareholder Agreement with any ‘controlling shareholders’, meaning any person who exercises or controls, on their own or together with any person with whom they are acting in concert, 30% or more of the votes able to be cast on all or substantially all matters at general meetings of the company.

Such agreement will govern dealings between the company and its controlling shareholder(s) and is aimed to ensure that the company is able to operate its business independently and that all transactions with the controlling shareholder are on arm’s-length terms. The agreement will, at a minimum, need to contain undertakings that: (i) transactions and arrangements with the controlling shareholder (or any of its associates) will be conducted at arm’s length and on normal commercial terms; (ii) neither the controlling shareholder nor any of its associates will take any action that would have the effect of preventing the company from complying with its obligations under the Listing Rules; and (iii) neither the controlling shareholder nor any of its associates will propose or procure the proposal of a shareholder resolution which is intended or appears to be intended to circumvent the proper application of the Listing Rules. It is also accepted market practice, but not a requirement, that a relationship agreement will be put in place by an AIM company with a 30% (or larger) shareholder. Despite

not needing to have traded for three years, we are probably at least two

years away from even considering such proposed IPO.

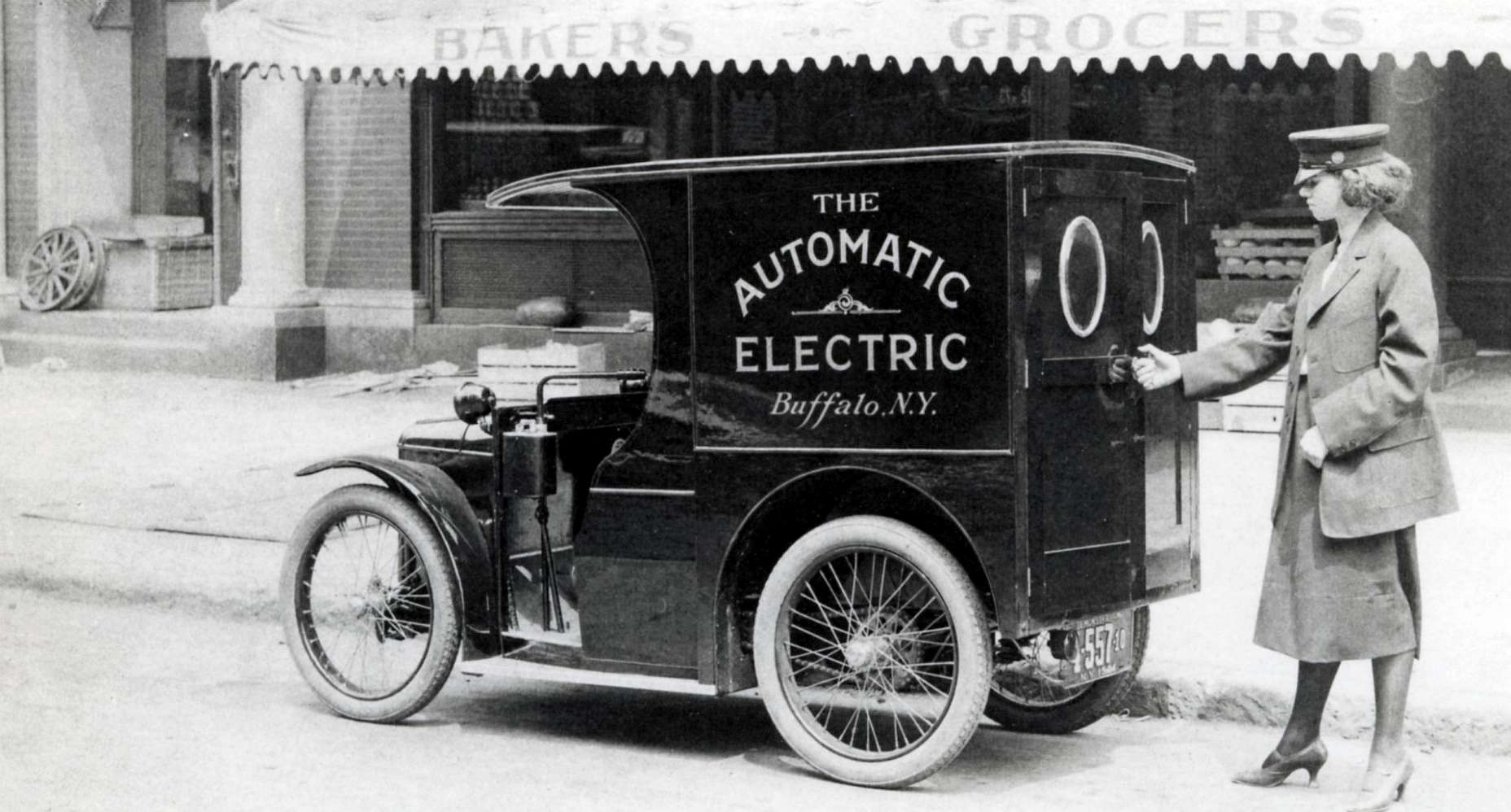

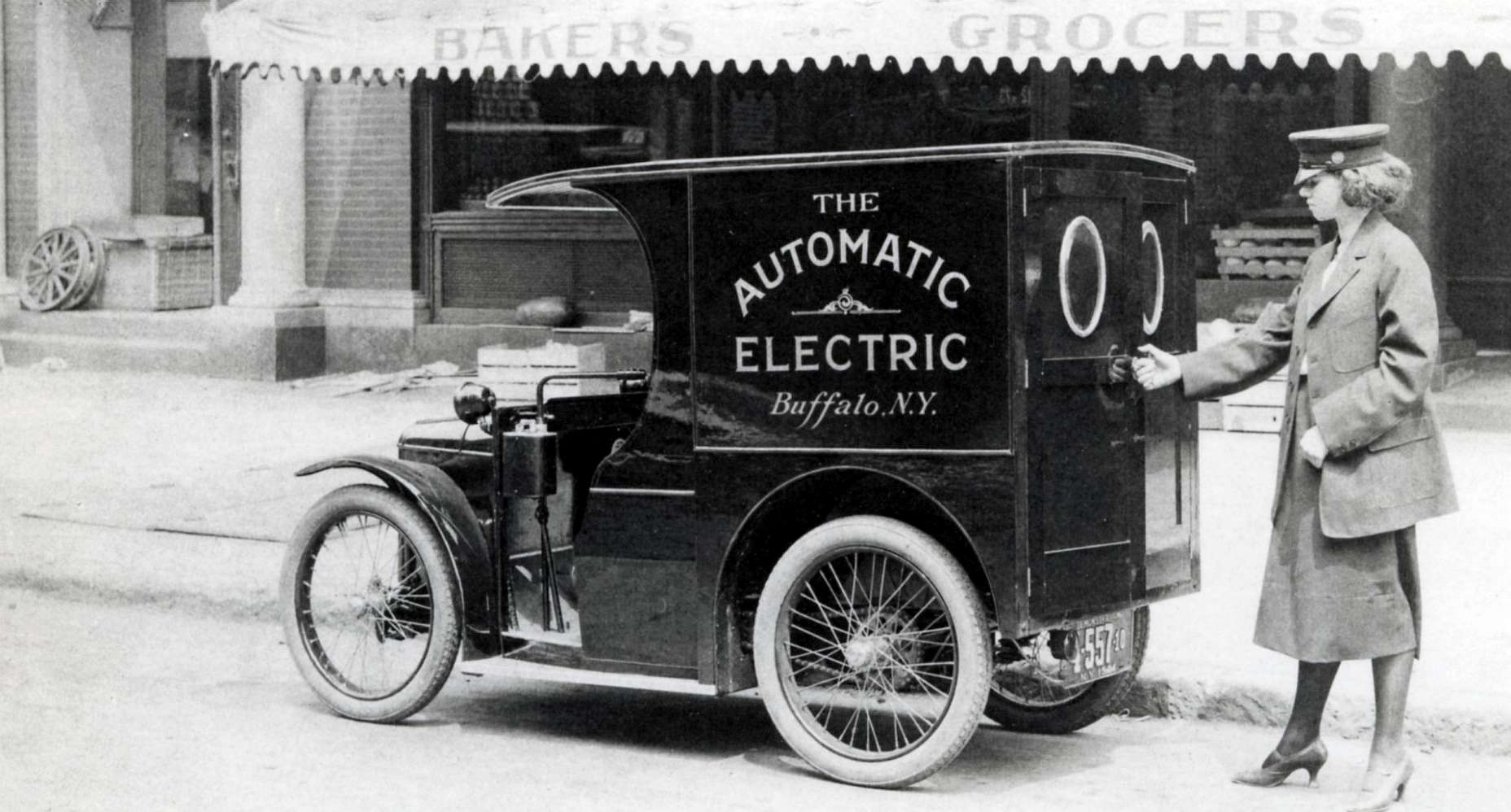

The

electric Buffalo from 1921,

seen here in New York as a postal delivery van.

Please

use our A-Z

INDEX to navigate this site

This

website is provided on a free basis as a public information service.

copyright © Climate Change Trust 2021. Solar

Studios, BN271RF, United Kingdom.

|